Exotic pets like snakes, parrots, and hedgehogs need special care. But finding the right insurance can be hard. Nationwide offers exotic pet insurance to help with vet bills, but costs vary.

As exotic pets become more popular, insurance plans like Nationwide’s are available. They offer special protection for these unique pets.

Key Takeaways

- Nationwide provides species-specific coverage for exotic pets, addressing their distinct health needs.

- Exotic pet insurance rates depend on the type of animal, location, and policy terms.

- Rare animal insurance helps cover high medical costs often linked to exotic species.

- Understanding nationwide exotic pet insurance cost structures helps plan budgets effectively.

- This guide explains how to choose policies that balance affordability with essential protections.

Understanding Exotic Pet Insurance Basics

Exotic pets need special care, and their insurance is no different. It’s key to understand the basics before looking at costs or policies.

What Qualifies as an Exotic Pet?

Exotic pets are more than just cats and dogs. They include animals like snakes, parrots, ferrets, and tarantulas. These pets need exotic pet healthcare that fits their unique needs, like special habitats or diets. Insurers look at the risks for each species when deciding on coverage.

How Exotic Pet Insurance Differs from Standard Pet Insurance

Exotic pet insurance is different from insurance for dogs or cats. It covers special challenges, like exotic pet medical costs for rare vets and emergencies. Nationwide pet coverage might include extra for habitat illnesses or specific breed issues, unlike regular policies.

Key Coverage Components to Consider

Good policies should cover:

- Accidents: Like injuries from trying to escape or environmental dangers

- Illnesses: Diseases specific to certain species, like metabolic bone disease in reptiles

- Wellness care: Regular check-ups and keeping parasites away

Looking at these parts ensures your policy fits your pet’s exotic pet healthcare needs. It’s about finding the right balance between coverage and cost.

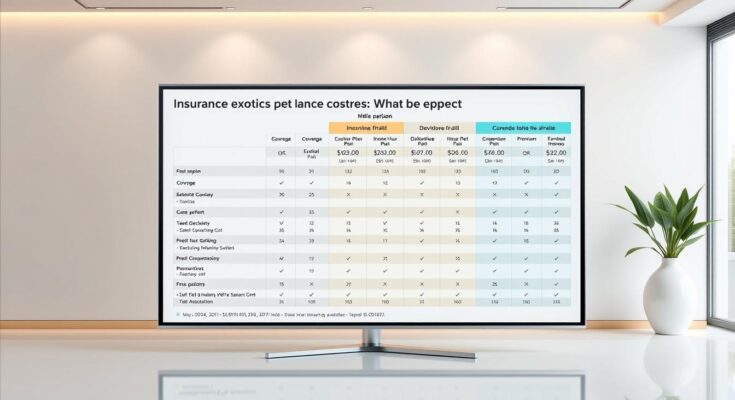

Nationwide Exotic Pet Insurance Cost Overview

The cost of Nationwide exotic pet insurance varies based on the pet’s species and the insurance plan. This guide helps owners understand the pricing factors. It covers premiums, coverage limits, and more to aid in making informed decisions.

Average Premium Ranges by Species

Reptile insurance starts at $20–$40 a month. Birds cost $30–$50. Small mammals like ferrets or sugar gliders are $15–$35. These prices reflect the health risks and vet costs of each species.

Deductible Options and Their Impact on Premiums

Deductibles help balance monthly costs with out-of-pocket expenses. Here are common options:

- $50 deductible: Lower out-of-pocket per claim but higher monthly premiums

- $100 deductible: Middle-ground choice for most owners

- $250 deductible: Lowers premiums but requires paying more upfront for claims

Annual Coverage Limits and Reimbursement Rates

Annual coverage limits range from $7,000 to $15,000. Reimbursement rates are 70–90% after deductibles. For example, a $10,000 limit with 80% reimbursement covers $8,000 of a $10,000 vet bill after deductible.

Factors That Influence Your Exotic Pet Insurance Rates

Exotic pet insurance rates vary based on many factors. These factors are unique to each pet and owner. Knowing these helps predict costs and choose the right coverage.

- Species and Breed: Some exotic pets need more medical care. For example, reptiles need special UV lighting, and birds are prone to respiratory issues. This can make exotic pet insurance rates higher.

- Pet Age: Younger pets usually have lower premiums. But older pets, with risks like arthritis or organ issues, cost more.

- Health History: Pets with pre-existing conditions, like shell rot in turtles or metabolic bone disease in lizards, may face higher premiums or exclusions.

- Location: Places with higher veterinary costs for exotic pets, like cities with few exotic vets, have pricier policies.

- Specialized Care Availability: Areas with more exotic vets may have lower exotic pet medical costs over time. This affects premiums.

Urban areas in Florida and California, with many exotic pets, often have competitive rates. This is because there’s more vet competition. Rural areas, with less specialized care, might have higher premiums. Owners can compare quotes from providers like Pets Unlimited or HealthyPaws to find the best fit for their pet.

Coverage Options for Different Exotic Pet Species

Exotic pets need special care, and their insurance varies a lot. Each type, from reptiles to arachnids, has its own health risks. Knowing these differences helps owners pick the best insurance.

Reptile Insurance Considerations

Reptile insurance covers health issues related to their unique body. Problems like metabolic bone disease and respiratory infections often come from bad heating or humidity. Policies might not cover issues caused by neglecting their habitat. The cost can go up for pets like bearded dragons, which need specific UV lighting.

Bird Insurance Policy Details

Bird insurance deals with diseases specific to birds. It covers stress-related feather plucking, respiratory issues, and diet-related problems. Birds like African greys, which live long and need complex care, might cost more.

Small Mammal Coverage Essentials

Insurance for small mammals, like ferrets and rabbits, covers dental and digestive problems. Rabbits often get dental issues from bad diets, leading to more vet visits and higher costs. Insuring more than one small mammal can save money.

Amphibian and Arachnid Coverage

Insurance for amphibians and arachnids is still growing but niche. These policies usually have shorter terms because these pets don’t live as long. For arachnids, like tarantulas, there might be limits on coverage for specific threats, like mites. The cost depends on how safe their enclosures are and how well they’re cared for.

Comparing Nationwide to Other Exotic Pet Insurance Providers

Choosing the right insurance for rare animals means looking at what’s covered and the cost. Nationwide is a top choice in the exotic pet market. But, it faces competition from Pet Assure and Healthy Paws. We’ll compare how each company handles policy design, pricing, and support for unusual pets.

Policy Feature Comparisons

Nationwide offers flexible rates for exotic pets based on their specific risks. Competitors like Pets Best also cover rare animals but might not offer as much for high-risk species. Here are the main differences:

- Nationwide: Covers 30+ species, including sugar gliders and chameleons

- Pet Assure: Focuses on wellness care for birds and reptiles

- Healthy Paws: Doesn’t cover some amphibians due to rules

Cost-Benefit Analysis

Insurance rates for exotic pets vary a lot. A 2023 study found:

- Nationwide averages $25-$50/month for reptiles

- Pet Assure is 15-25% cheaper but has a $10,000 annual cap

- Wells Fargo Bank offers 10% discounts for bundling policies

Looking for cheaper insurance might mean less coverage for rare animals. Owners should think about what’s most important for their pets.

Customer Satisfaction Ratings

Nationwide is quick to respond to claims (3 business days) but has limited 24/7 support. Pet Assure is known for its vet network, while Healthy Paws gets mixed reviews on pre-existing conditions. Check out reviews to see if a provider meets your pet’s needs.

Common Exclusions and Limitations in Exotic Pet Policies

It’s important to know what exotic pet healthcare policies don’t cover. Many plans don’t cover pre-existing conditions. This means health issues found before you sign up aren’t covered. Cosmetic treatments like tail trimming or changing colors are usually not covered unless they’re needed for health reasons.

Breeding-related costs, including problems during breeding, are often not covered. This is because these costs are not part of the standard policy.

- Experimental treatments: New or unproven therapies may not be reimbursed under standard policies.

- Behavioral issues: Injuries from escapes or aggression are rarely covered, even if caused by environmental stressors.

- Age restrictions: Some insurers cap coverage for pets older than 5–8 years, impacting older reptiles or birds.

- Species-specific limits: Certain species like venomous snakes or large primates face stricter deductible requirements or coverage caps.

Most policies have a 14–30 day waiting period for claims. This means you might have to wait for reimbursement in emergencies. Preventative care, like routine checkups, might have limited coverage. This means you could still have to pay for some of the costs of caring for your exotic pet.

It’s a good idea to review these terms carefully. This way, you can budget for any gaps in coverage. For more information, you can contact providers like Nationwide directly. They can give you a detailed explanation of what’s covered and what’s not.

How to Save on Exotic Pet Insurance Without Sacrificing Coverage

Managing nationwide exotic pet insurance cost doesn’t mean cutting corners. These strategies help owners reduce expenses while keeping coverage strong. Start by exploring multi-pet discounts and wellness programs designed to lower long-term spending.

Bundle Discounts and Multi-Pet Options

Nationwide offers multi-pet discounts for households with multiple exotic pets. Enrolling all pets on one policy can cut premiums by up to 15%. For example, pairing a reptile and a bird on a single plan often reduces the total cost more than insuring them separately.

Preventative Care Strategies

Exotic pet wellness plans focus on early health maintenance. Regular vet checkups, proper habitat setup, and species-specific nutrition prevent costly emergencies. Consider these steps:

- Use UVB lighting for reptiles to avoid metabolic bone disease

- Monitor humidity levels for amphibians to prevent skin infections

- Provide flight-safe cages for birds to reduce injury risks

Payment Options and Savings

Paying premiums annually with Nationwide can save 5-10% compared to monthly payments. Compare options in the table below:

| Payment Type | Discount | Pros | Cons |

|---|---|---|---|

| Annual Payment | 5-10% off | Lower overall cost | Requires upfront payment |

| Monthly Payment | 0% discount | Easier budgeting | Higher total cost |

Combining these methods can lower costs without weakening coverage. Pairing discounts with proactive care creates a sustainable financial plan for exotic pet ownership.

Real Cost Scenarios: What Exotic Pet Owners Actually Pay

Exotic pet healthcare costs can vary a lot. But, real-life examples show how insurance helps cover these costs. Here, we look at some actual financial impacts.

| Pet Type | Condition | Total Medical Cost | Insurance Coverage | Out-of-Pocket |

|---|---|---|---|---|

| Bearded Dragon | Metabolic Bone Disease | $500 | $400 | $100 |

| Blue-and-Yellow Macaw | Respiratory Infection | $2,000 | $1,600 | $400 |

| African Pygmy Hedgehog | Inguinal Surgery | $1,500 | $1,200 | $300 |

Unexpected costs can include:

- Emergency surgeries for reptiles like intestinal blockages

- Specialized imaging (CT scans, X-rays) for birds

- Extended care for amphibians with chronic infections

Looking at the long-term, insurance can save a lot of money:

| Pet Type | Annual Premium | Total 3-Year Premiums | Total Claims Paid | Net Savings |

|---|---|---|---|---|

| Bearded Dragon | $240 | $720 | $1,500 | $780 |

| Macaw | $480 | $1,440 | $3,000 | $1,560 |

These examples show how insurance can really help with exotic pet costs. For example, a macaw owner pays $40 a month for three years. They spend $1,440 but get $3,000 in claims, saving $1,560. This shows that insurance can be worth it.

Conclusion: Is Exotic Pet Insurance Worth the Investment?

Deciding on exotic pet insurance is about weighing costs against risks. Nationwide’s exotic pet insurance costs vary, but it covers many species. If you have a high-value pet or one that’s prone to expensive health issues, it might be worth it.

For instance, a snake with breathing problems or a primate needing special care could really benefit. This insurance can help cover unexpected vet bills.

Insurance rates change based on the pet and the coverage level. Nationwide’s plans can cover up to 90% of vet costs after deductibles. But, premiums go up for pets at higher risk.

If you have a lot saved for emergencies and own a low-risk pet, like some rodents, you might not need insurance. But, sudden illnesses or accidents can still cost a lot more than you expect.

Comparing Nationwide to others shows they offer broad coverage for less common pets. Their customer service and claims process are also praised. But, you need to think about deductibles and how much they’ll cover.

For example, a healthy tortoise might cost less to insure than a young, active sugar glider. It’s all about finding the right balance for your pet’s health and your budget.

In the end, Nationwide’s exotic pet insurance is best for those who want financial security for their pets. Before buying, look at your pet’s health history and compare costs in your area. This way, you can choose a plan that fits your budget and your pet’s needs.